Nigerian credit startup, Migo formerly known as Mines.io, has raised $20m in a Series B funding round to aid its expansion to Brazil.

The funding round was led by Valor Group Capital, an investment firm focused on Brazil, with participation from Africinvest and Cathay Innovation as well as existing investors Velocity Capital and The Rise Fund.

Migo has now raised $37 million so far.

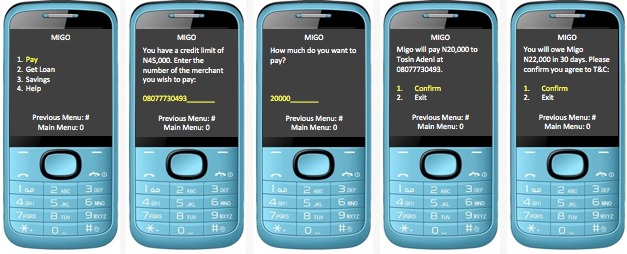

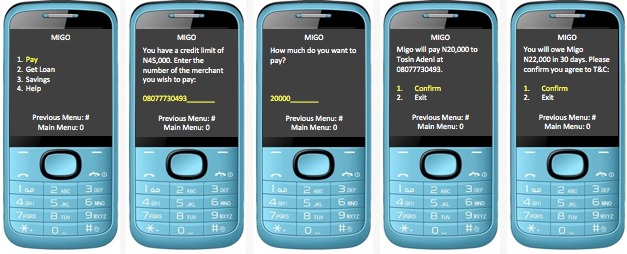

Launched in Nigeria in 2013, Mines.IO now Migo, is a credit company that has developed a proprietary credit rating using AI and machine learning, for financial institutions to offer credit to their middle and low-income consumers customers.

This is because these segments of the market are mostly overlooked since they have no existing credit rating to facilitate credit facilities.

But by integration of Migo’s API into their apps banks, fintech operators are able to get markets insights on customers before granting credit to customers. And the startup, so far, has several partner clients including big names like to-be African Unicorn, Interswitch and biggest telco, MTN.

And according to the company’s stats, the company has facilitated over 3 million loans to over 1 million customers in Nigeria since 2017.

The company reportedly chose Brazil as its next spot outside Africa because of the similarities of its market with that of Nigeria – similar population (Nigeria, over 200 million and Brazil, 290 million) and similar underserved population.

“Statistically, the number of people without credit in Nigeria is about 90 million people and its about 100 million adults that don’t have access to credit in Brazil. The countries are roughly the same size and the problem is roughly the same.”

Migo founder and CEO Ekechi Nwokah

As such the rebrand from Mines.io to Migo helps the company better communicate its values to the Brazilian market.

And with a credit solution that has been tested to be effective, Migo can expand to several other markets, developed and developing. However, the company says it is eyeing Asia as its next stop.