Abeg, now PocketApp, a social payments company owned by PiggyVest has been granted an approval in principle (AIP) by the Central Bank of Nigeria (CBN) to operate as a Mobile Money Operator (MMO), consequently becoming Nigeria’s first social commerce platform to secure the CBN’s AIP for an MMO license.

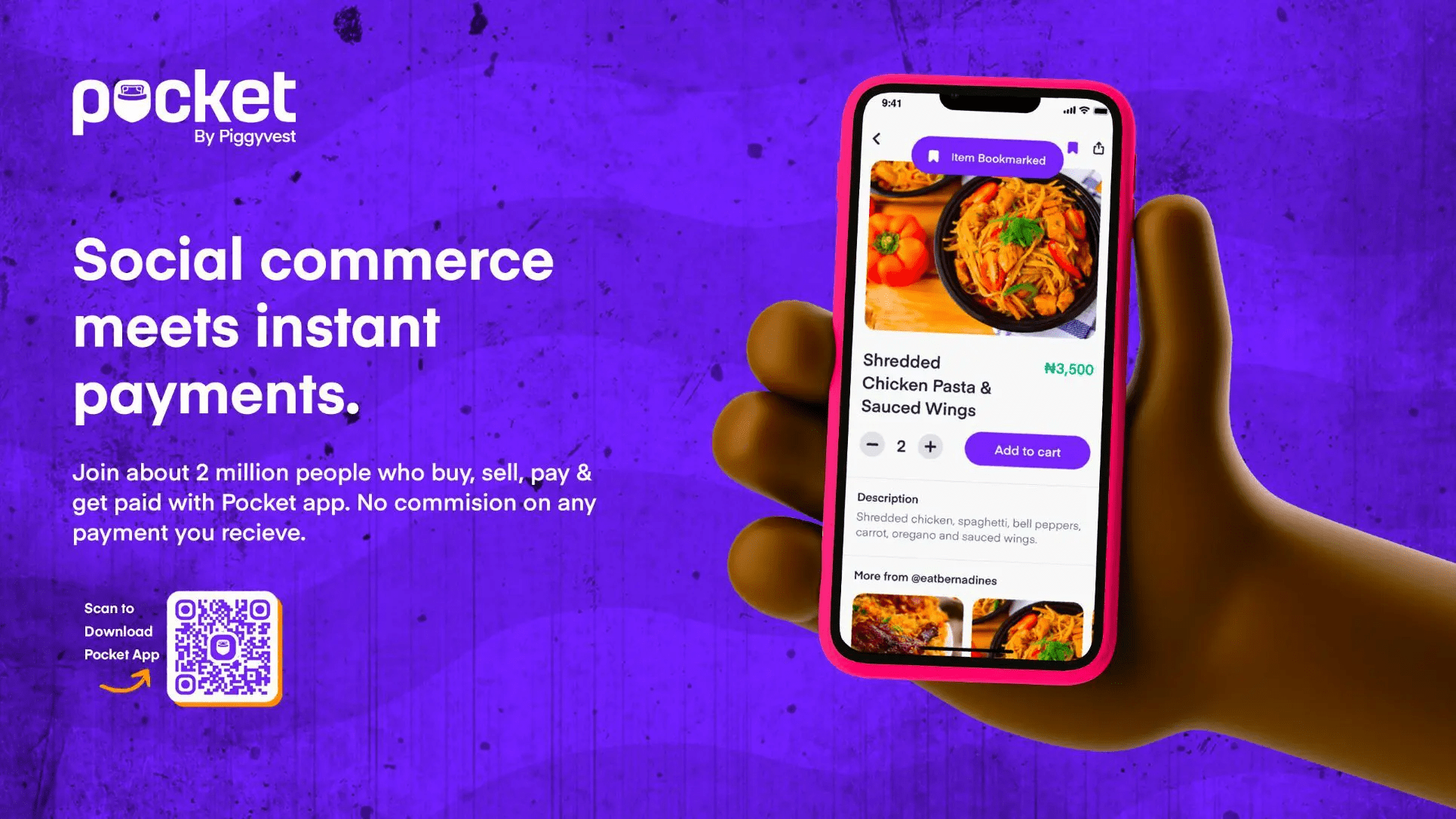

In a move to underline this evolution from a money transfer app to a social commerce platform, Abeg is rebranding to “Pocket by PiggyVest”, simply called PocketApp.

The platform’s new name references its added functionalities for users to buy and sell items via virtual pocket shops and reinforces its push into a social commerce market estimated to reach US$23.8 billion by 2028 in Nigeria alone.

Related story: GTBank gets PSB license for HabariPay, joins MTN, Airtel in race for the unbanked

In a statement, the Co-founder and Chief Operating Officer of the platform, Odunayo Eweniyi noted that they were delighted with the new development which gives them an opportunity to grow and expand their scope as a social commerce platform while also providing payment services

We’re incredibly pleased that PocketApp has been granted an approval in principle as a Mobile Money Operator in Nigeria. We will now work closely with the Central Bank to meet all its conditions to receive the full operating license, enabling us to continue growing and expanding the scope of our social payments, social commerce and other digital financial products to reach millions of Nigerian micro-entrepreneurs.

Odunayo Eweniyi, Co-Founder and COO of Piggytech Global Limited

About PocketApp

PocketApp received an AIP dated April 25, 2022, from the CBN for a license application to operate as a Mobile Money company.

For the PiggyTech subsidiary, this is the first step towards final approval, subject to the fulfillment of certain conditions as stipulated by the CBN.

The brand has affirmed its commitment to the financial inclusion agenda of the CBN and Nigeria while continuing on a mission to make it easier for Nigeria’s teeming young population to seamlessly carry out their transactions while saving them costs and giving them more access to get paid.

The Mobile Money Operator license will enable the company to carry out activities around: Wallet Creation and Management, E-money issuing, USSD, agent recruitment and management, pool account management, non-bank acquiring as stipulated in the regulatory requirements for non-bank merchant acquiring in Nigeria, card acquiring, and any other activities that may be permitted by the CBN.

Speaking on the company’s evolution, Patricia Adoga, COO of PocketApp, states:

For the last 18 months, we have been focused on building the core infrastructure that will enable secure social commerce and payments at scale. We believe that social commerce will thrive better in a more trusted environment. So we added escrow to our payment infrastructure, protecting buyers and sellers and many other features, ensuring a smooth shopping experience on the app.

Patricia Adoga, COO of PocketApp

What this means for e-commerce platforms

The announcement marks a crucial development in the company’s bid to support seamless payments and online commerce throughout the country.

The new development also paves a way for other e-commerce companies to leverage the existing gap in access to financial possibilities, wealth, and opportunities, while corroborating the efforts of financial institutions in driving financial inclusion in the country.

Read also: MTN’s mobile money service, MoMo begins operation In Nigeria

The Abeg App was launched in 2019 and already has about two million users, starting as a payment platform for sending and receiving money.