Ceviant, a UK-based financial technology company delivering treasury and trade solutions to corporates, has received its Payment Solution Service Provider (PSSP) License from the Central Bank of Nigeria.

The license permits Ceviant to offer a range of payment services to clients in Nigeria, including electronic fund transfers and payment processing.

This license presents further opportunities to partner with banks and other financial institutions within the payments ecosystem, including API integrations with banks, enabling businesses to manage bank accounts, payments, transactions, cash balances, and more, all through a single portal and API.

Ceviant’s FCA license in the UK also allows access to the UK’s financial services ecosystem, making it easier for businesses to manage payments and transactions through a single platform.

With both licenses, the fintech is poised to provide a more comprehensive range of financial services to customers across Europe and Africa.

Read also: Fincra receives PSSP license from the Central bank of Nigeria

In a statement made available to Technext, Kehinde Dabiri, CEO of Ceviant, said, “We are proud to have been granted the PSSP license from the Central Bank of Nigeria. This demonstrates our dedication to providing exceptional payment solutions that meet the necessary regulations.

Dabiri also explained the company’s mission to ease payments by providing transparency and Automation for its users. Ceviant provides Multinational Businesses access to its treasury and trade solutions, focusing on reducing costs and making global business transactions more efficient.

“We aim to provide integrated treasury and trade solutions that give our customers more data transparency, automation, visibility, and control of their payments and treasury operations.”

“Receiving the PSSP license is a major achievement for Ceviant. It highlights our dedication to maintaining the security and accuracy of all payment processes. Our team worked hard to meet the demanding standards set by the Central Bank of Nigeria, and we are confident that our payment solutions will continue to meet the changing needs of Nigerian businesses.”

How the PSSP License would help Ceviant’s mission

The PSSP License enables Ceviant to securely offer its services in Nigeria with features and capabilities that meet local banking requirements. Ceviant is now well-positioned to capitalize on Nigeria’s growing payments market and meet the needs of businesses seeking secure and efficient payment solutions.

Payments are a critical component of treasury management. Treasurers require real-time visibility of cash balances, stress-free money movement, and safe investment options to preserve liquidity.

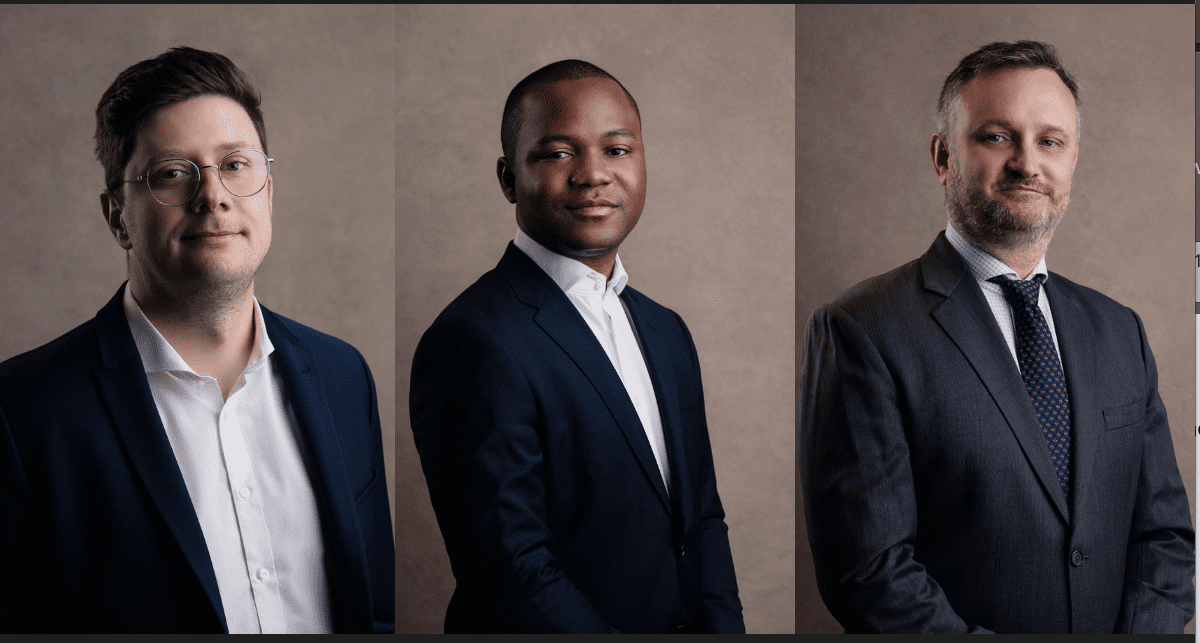

Ceviant’s Executive Management team has a proven track record that spans payments, mobile banking and digital solutions. Its Co-Founders have established successful fintech businesses, that include ARCA and Vanso [which was acquired by Interswitch in 2016.

Headquartered in London, with offices in Bucharest and Lagos, Ceviant is a member of the SWIFT partner program and is ISO accredited. Currently operating in Nigeria and the UK, the company is expanding to other countries in the EMEA.

Read also: Chipper Cash receives license to provide money transfer services in Malawi