Nigerian digital bank, Kuda has raised $25 million in Series A funding. The round was led by Peter Thiel’s Valar Ventures, with participation from Target Global and other unnamed investors.

Kuda’s latest funding follows its $10 million raise in November 2020, the largest ever seed round in Africa. European VC firm, Target Global had led the Kuda’s seed round but its Series A marks the first investment in an African startup by US-based VC, Valar Ventures.

Kuda has now secured up to $36.5 million in total funding across three rounds including pre-seed and seed financing.

Armed with new investment, Kuda plans to build out its mobile-first banking service for Africans on the continent and in the diaspora. In the words of Kuda CEO, Babs Ogundeyi, the company wants to offer digital banking services to “every African on the planet, wherever you are in the world.”

Kuda is currently live only in Nigeria but the startup is looking to enter the diaspora market to provide banking services to Africans outside Africa. Headquartered in the UK and Nigeria, Kuda could be setting its sights on going live in the UK – which is home to about 215,000 Nigerians, according to the Office for National Statistics.

Moreoever, Kuda plans to leverage its Series A investment to expand its digital banking service beyond Nigeria into other African countries.

“It will let us fast track teams, on-the-ground operational teams,” he said.

According to Ogundeyi, Kuda has added more than 200% of its 300,000 customers as at the time of its seed round to reach 650,000 users of its digital banking app.

The CEO says the company has seen a massive 340% growth in monthly transactions processed through its platform in the space of three months.

In November we were doing about $500 million in transactions per month. We closed February at $2.2 billion.

Babs Ogundeyi, Kuda CEO

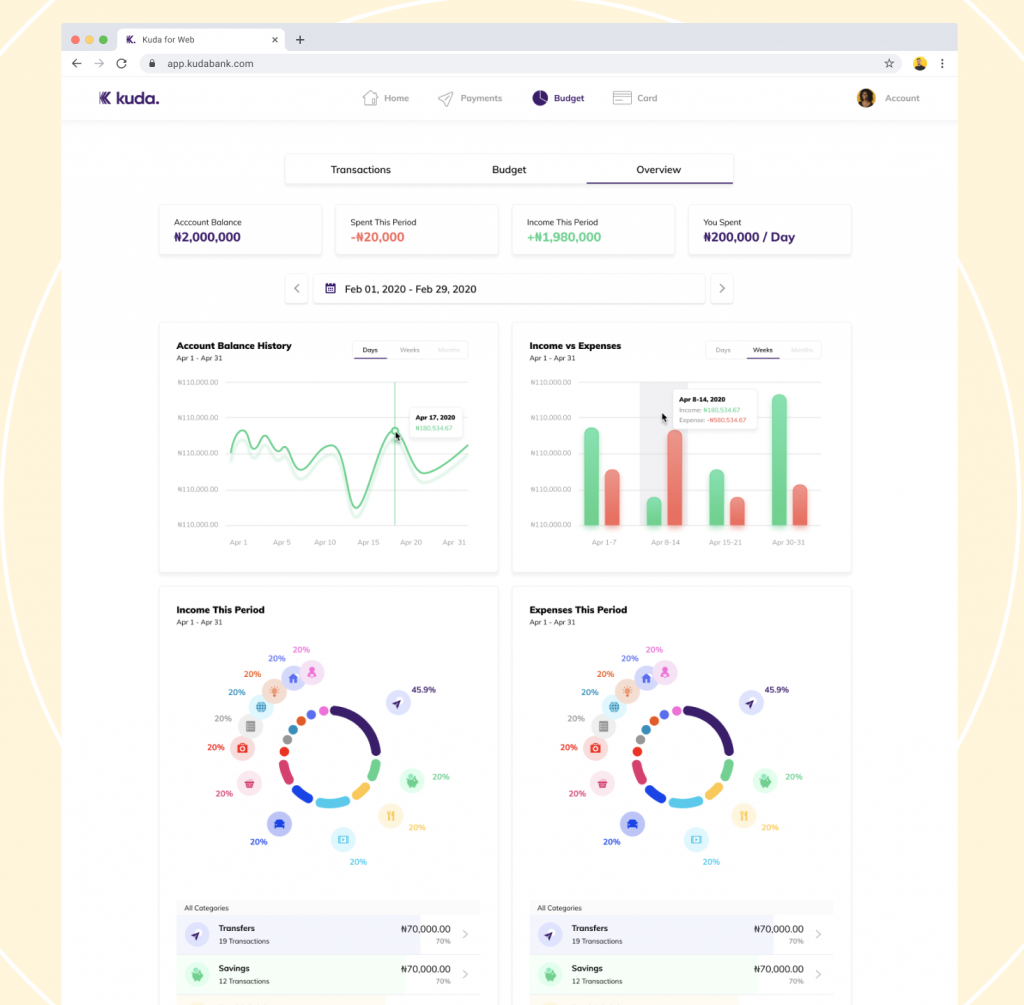

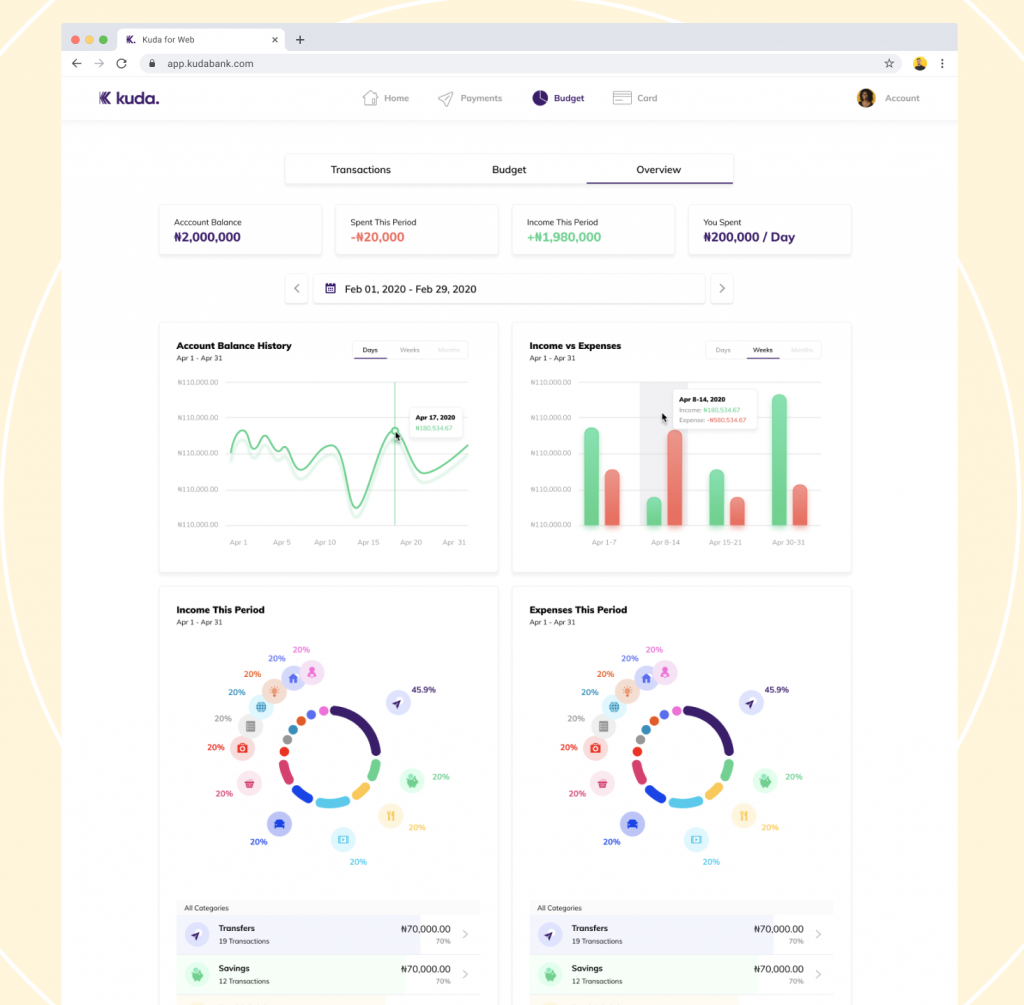

With a microfinance banking license from the Central Bank of Nigeria C(BN), Kuda currently provides saving services for users to spend money and plans to expand its credit offerings such as loans going forward.