The world over, finance options and transactions are undergoing a massive transformation. As individuals and organisations adopt more effective digital solutions to solve challenges in virtually all aspects of life, payments, lending, asset, and wealth management are also being reshaped by digital technologies. Nigeria’s financial landscape has not been left behind.

A September 2020 report by McKinsey said Nigeria is home to over 2,00 fintech standalone companies, and fintech solutions offered by banks and mobile network operators as part of their product portfolio.”Between 2014 and 2019, Nigeria’s bustling fintech scene raised more than $600 million in funding, attracting 25 per cent ($122 million) of the $491.6 million raised by African tech startups in 2019 alone— second only to Kenya, which attracted $149 million,” the report said.

While these innovations are blurring boundaries and giving rise to new market leaders in the financial services sector, only organisations and business leaders with a full understanding of the new and emerging world will be susceptible to change and move with the times without being left behind by the moving tide.

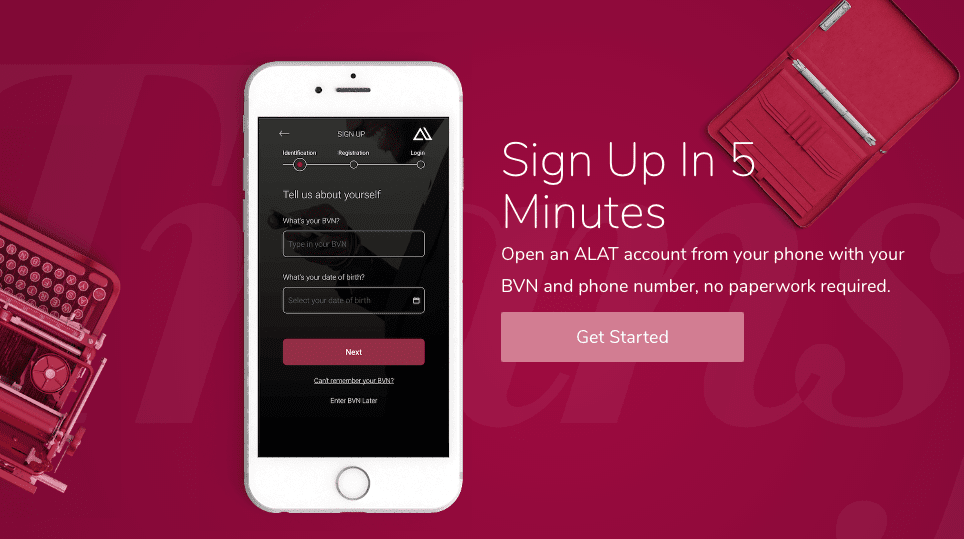

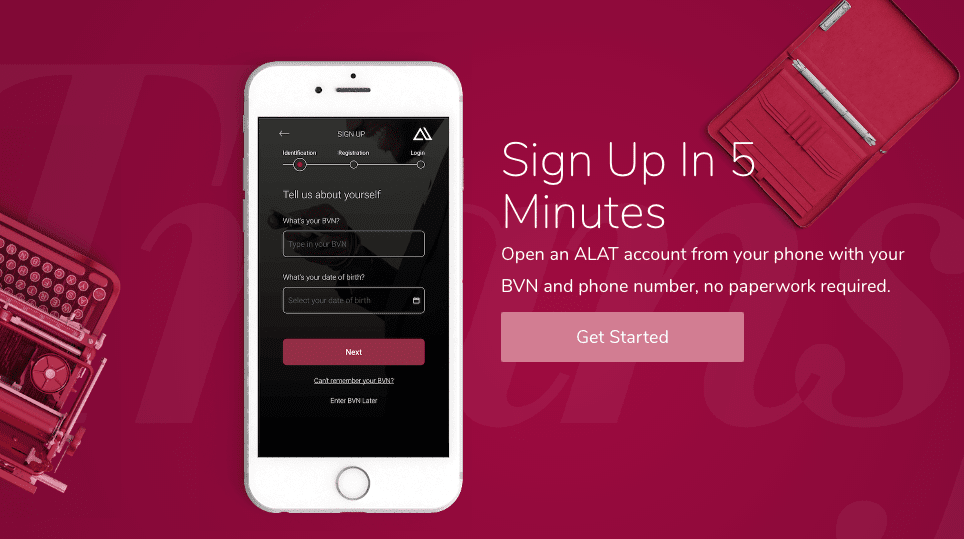

A prime example is Nigeria’s Wema Bank, which is featuring prominently in the new era of Nigeria’s financial services – considering they launched the first digital bank, ALAT, in 2017 Now, the digital bank has moved beyond leading the digital revolution in the banking sector, Wema Bank has become the power driving many fintech companies operating in Nigeria.

In February 2021, when some of Nigeria’s Fintech startups were thrown off balance over regulatory issues, ALAT came to their rescue. It helped them douse the fears of investors and keep their businesses running.

Piggyvest, one of Nigeria’s leading digital savings and investment technology platforms, with over three million users, announced to its users in February 2021 that it has teamed up with Wema. This switch was due to Wema’s virtual accounts service that enables the fintech company to carry out its businesses seamlessly.

Also on the list of fintech companies that have adopted Wema for their operations are Cowry (BRT) and other Quick Loan apps.

When Wema Bank and ALAT’s Managing Director, Ademola Adebisi, declared that “banking is a lot different today than it was at the start of my career over 30 years ago,” it also confirms that the bank’s leadership understands the present and the future and is ready to feature prominently in it.

Adebise is also not unaware of the Nigerian teeming youth factor when he added:

“Many years ago, you were likely to get a job and become financially independent within a few years after graduation. Sadly, this isn’t the case for young Nigerians right now – a group that constitutes about 42.5 per cent of the national population. The population of Nigeria has grown exponentially, and with it has come increased competition for jobs. To make up for this, more young people are starting businesses and embracing creative career choices. They are taking control of their destinies.”

With the marriage of the two phenomena — banking and the youth — it will not be out of place to say that Wema Bank saw into the future when it dared to introduce ALAT by Wema, long before other banks caught up and long before the fintech bug bit our ecosystem.

“We saw the inevitable future coming, and we have positioned ourselves to play a massive role in bringing it to fruition. We introduced ALAT in 2017 as a bank that is flexible and intuitive, a perfect match for Nigerians who value their time and enjoy the convenience that technology brings,”

– Adebise had explained in a recent piece

Today, ALAT boasts of over 574,242 customers and has processed over 43,000,000 transactions worth over N1 trillion.

According to data from the Nigerian Inter-Bank Settlement System (NIBSS), just 43 million Nigerians have Bank Verification Numbers (BVN) – less than 50 per cent of the adult population.

Its virtual account services, which allows users to open an account from any part of the world, is also helping to drive financial inclusion among young Nigerians. That unique feature allowed music star, David ‘Davido’ Adeleke, to open a bank account from his hotel room in Dubai to raise N200 million for charity in just 72 hours.

With Davido, who commands a large global following, now aboard the ALAT by Wema team, Wema Bank’s financial inclusion drive has just gotten a huge boost.

ALAT is also taking a step further, this time by announcing the return of the 2022 edition of its Hackathon programme tagged #Hackaholics 3.0 – Building The Future. The initiative is aimed at helping tech enthusiasts and innovators scale and gains entrance into the market. It is targeted at young Nigerians who will put their coding, product curation, and pitching skills to work, by solving interesting problems.

As fintech will continue driving greater access to and the convenience of financial services for Nigeria’s young population, industry players like ALAT by Wema will increasingly be tapped by startups to strengthen their businesses and the services they render.